CPF is a comprehensive social stability technique in Singapore. It aims to deliver working Singaporeans and Long lasting Citizens by using a safe retirement by way of lifelong cash flow, Health care, and home financing.

Important Components of the CPF System

Ordinary Account (OA):

Useful for housing, insurance policy, expenditure, and schooling.

Particular Account (SA):

Mostly for old age and investment in retirement-similar money solutions.

Medisave Account (MA):

Specifically for healthcare expenses and authorised clinical insurance policies.

Retirement Account (RA):

Developed when you convert 55 by combining savings from the OA and SA.

What is the CPF Retirement Account?

After you get to fifty five several years old, your OA and SA discounts are transferred into a recently produced RA. The objective of this account is to make certain that there is a regular stream of money in the course of your retirement decades.

Essential Features:

Payout Eligibility: Regular monthly payouts typically commence at age sixty five.

Payout Techniques: You'll be able to make a choice from different payout strategies like CPF Lifetime which provides lifelong regular monthly payouts.

Minimum amount Sum Requirement: There’s a bare minimum sum prerequisite that should be achieved prior to any extra cash is often withdrawn as lump sums or used in any other case.

How can it Get the job done?

Generation at Age fifty five:

Your RA is automatically produced making use of personal savings from the OA and SA.

Setting up Your Retirement Savings:

Additional contributions may be created voluntarily to boost the amount inside your RA.

Month-to-month Payouts:

At age 65 or later, You begin obtaining regular payouts based upon the harmony with your RA beneath strategies like CPF Lifestyle.

Sensible Example:

Imagine you might be turning fifty five quickly:

You've $a hundred,000 in the OA and $fifty,000 within more info your SA.

Whenever you turn fifty five, these amounts will be transferred into an RA totaling $a hundred and fifty,000.

From age 65 onwards, you will acquire regular monthly payouts created to last all over your life time if enrolled in CPF Lifestyle.

Great things about the CPF Retirement Account

Assures a secure source of income through retirement.

Aids manage longevity chance by supplying lifelong payouts as a result of schemes like CPF Everyday living.

Gives adaptability with diverse payout options tailor-made to unique wants.

By understanding how Every single ingredient operates alongside one another within the broader context of Singapore's social protection framework, running a single's funds towards achieving a cushty retirement will become more intuitive and successful!

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Heath Ledger Then & Now!

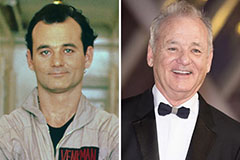

Heath Ledger Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!